non filing of tax return meaning

Your income is more than 12400 Note. Bookkeeping Taxes Payroll More.

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Today my transcripts updated to show the following under Return Transcript for 2020.

. Available from the IRS by calling 1-800-908-9946. Live QA with an Expert. The specifics regarding imprisonment are as follows.

As of the date of. If requested on your FAST page please obtain a Verification of Non-Filing letter from the IRS and submit a copy to the Financial Aid Office. The total penalty for failure to file and pay can eventually add up to 475 225 late filing 25 late payment of the tax owed.

There are some myths associated with filing. Follow prompts to enter the. The Non-filling of the Income Tax returns leads to attracting the interest penalty and their.

Examination uses this procedure to establish an account and examine the records of a taxpayer when the taxpayer refuses or is unable to file and information received indicates. Ad See If You Qualify For IRS Fresh Start Program. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due.

If you have self-employment income over 400 you are required to file a federal tax return even if your total income is under 12400 You are. Whether the non-compliance is a mere omission. In the disqualification case is that his conviction for violation of the Tax Code is merely for non.

With the exception of. BY ANTONIO T. CARPIO THE PRINCIPAL defense of Ferdinand R.

Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7. You must file if. The Madhya Pradesh High Court has observed that mere non-filing of Income Tax Return would not automatically dislodge the source of income of the complainant in a cheque bounce case under Section.

Filed a 2019 federal income tax return and you listed all your qualifying children or. However the benefits lost on non-filing of returns are more than the penal provisions imposed for non-filing. Based On Circumstances You May Already Qualify For Tax Relief.

Ad A Tax Advisor Will Answer You Now. Tax filers must follow prompts to enter their social security number. Flores the Supreme Court agreed with its investigating officer that evasion of income tax is a crime involving moral turpitude.

The tax liability of a taxpayer is calculated based on. Are required to file a 2020 federal income tax return. In some cases the student will receive IRS Form 13873 from the IRS instead of a Verification of Non-filing Letter.

For possible tax evasion exceeding Rs25 lakhs. An Income tax return ITR is a form used to file information about your income and tax to the Income Tax Department. Ad Serving Small Businesses.

Non-filing of Income Tax Return by itself would not mean that the complainant had no source of income and thus no adverse inference can be drawn in this regard only. If case is in Status 08 or below follow IRM 41917521 NFR Non-Filer Reject Return Received Prior to Non-Filer Initial Contact Letter ICL above. A student or parent who has never.

Following are the benefits of filing of the income tax returns. On June 18 2021 we received a request for verification of non-filing of a tax return. Free Case Review Begin Online.

Select Option 1 for English. Interest compounded daily is also charged on any unpaid tax from the due date of the return until the date of payment. In addition to non-filing of the income tax returns within the due dates if the specified person does not furnish PAN to the payer then the TDS rate shall be higher of the.

The point is that failing to file a tax return should never be an option. Consequently the defenders of Marcos Jr who readily admit that the crime. In the 1979 case of Zari v.

Book An Appointment Today. Providing Better Faster Tax Returns For Individuals Businesses. People generally do not take the filing of the income Tax returns seriously.

The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public. Since failure to pay income tax which is tax evasion involves moral turpitude then non-filing of ITR also involves moral turpitude. PENALTIES FOR LATE FILING OF TAX RETURNS.

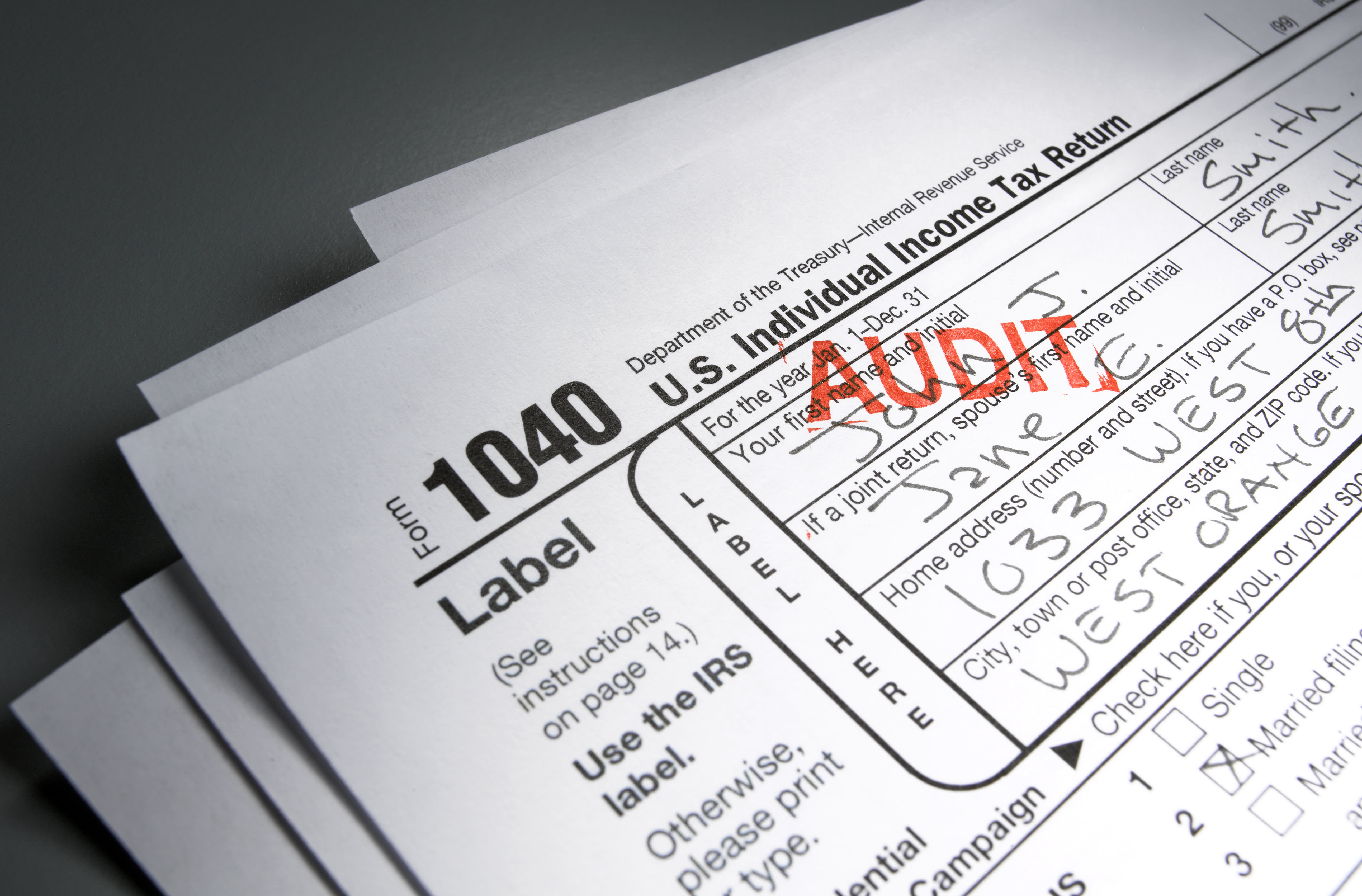

Here S Why Your Tax Return May Be Flagged By The Irs

How To File Tax Returns By Individuals With Employment Income Only Using The Pre Populated Income Youtube

Common Usa Tax Forms Explained How To Enter Them On Your Canadian Tax Return 2022 Turbotax Canada Tips

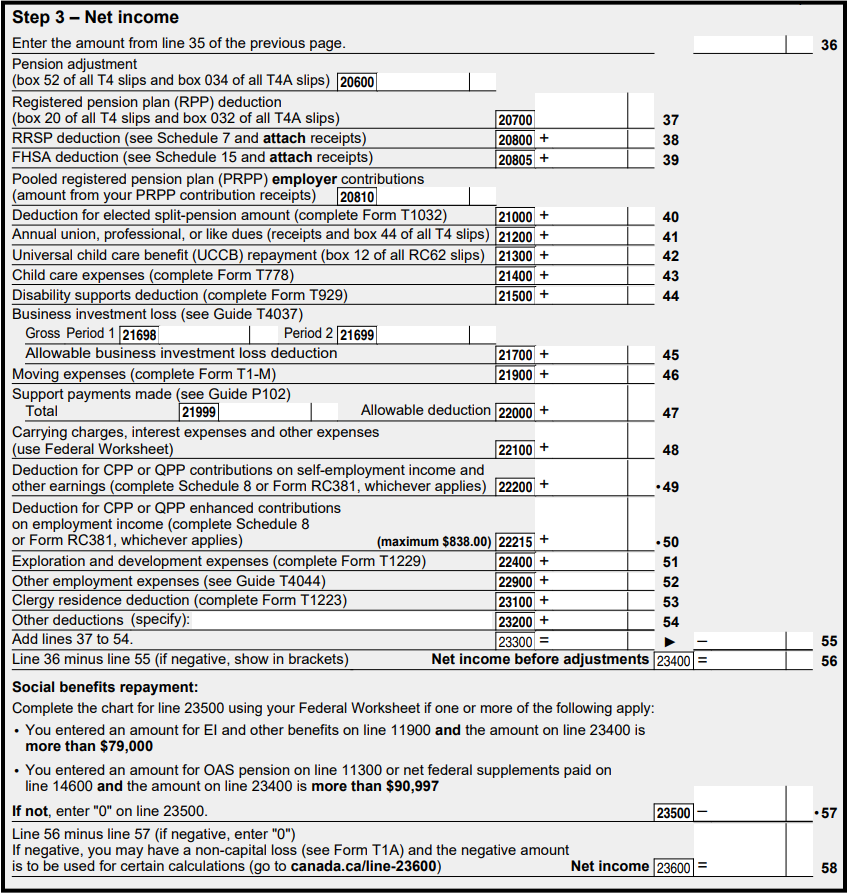

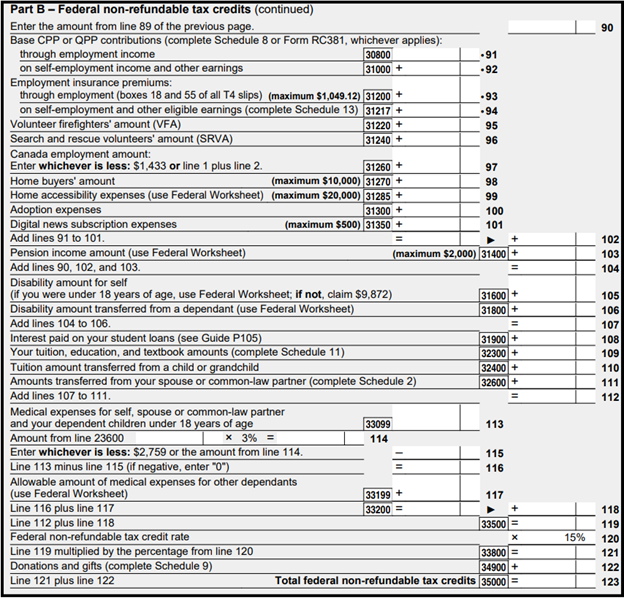

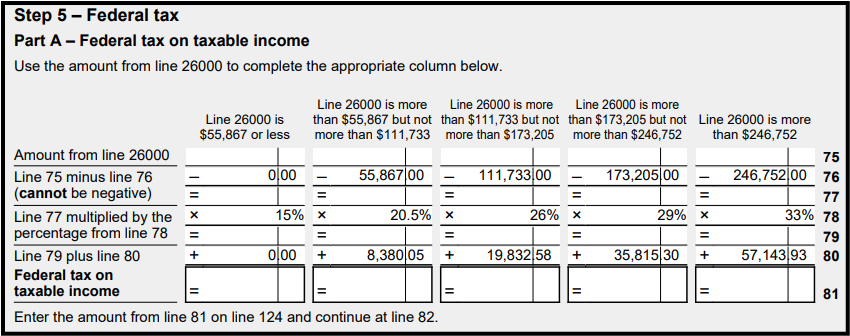

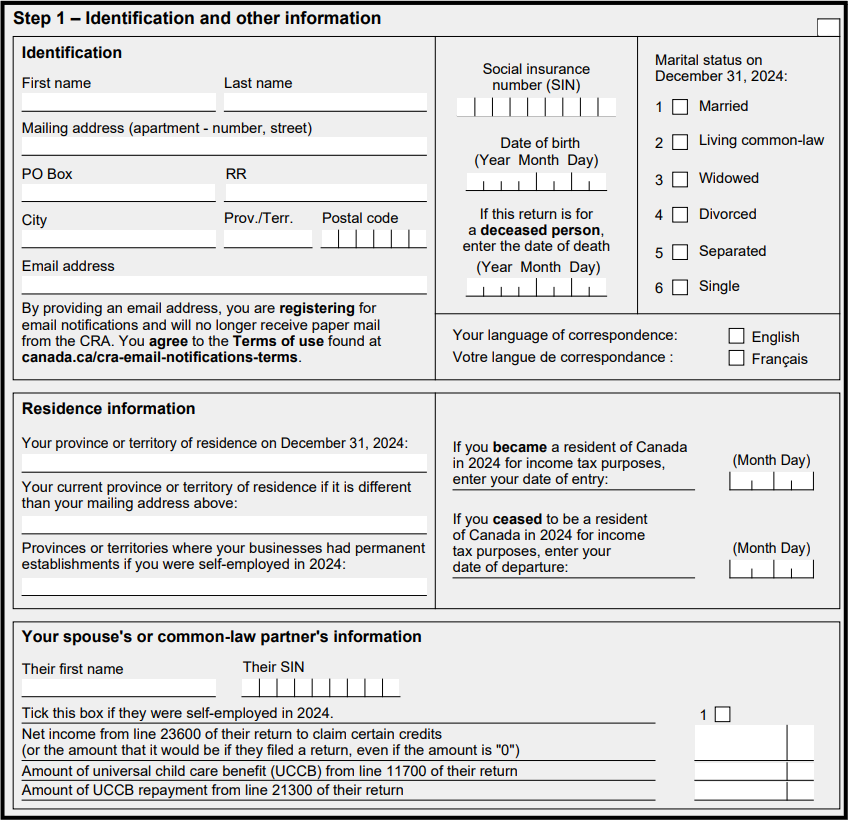

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To File Your Uk Taxes When You Live Abroad Expatica

Who Should File Income Tax Return In Canada Consolidated Canada

Do You Know About Annual What Is Annual Return Gstr 9 Know About The Due Date Eligibility Filing Format And The Penalty Levied Due Date Meant To Be Dating

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

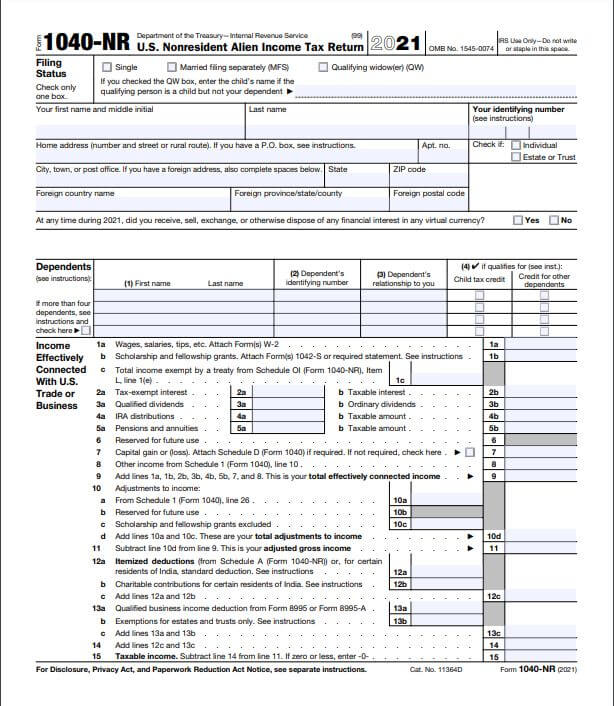

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

What To Do If You Receive A Missing Tax Return Notice From The Irs

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Do Nris Need To Disclose Foreign Account Details In Tax Returns Sbnri

How To Fill Out A Fafsa Without A Tax Return H R Block

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Register On The Income Tax Website And File Returns Income Tax Income Tax Return Filing Taxes

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)