richmond property tax rate

Real property consists of land buildings and attachments to the land andor. Greater Vancouver Transportation Authority TransLink 604-953-3333.

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

These documents are provided in Adobe Acrobat PDF format for printing.

. For all who owned property on January 1 even if the property has been sold a tax bill will still. City of Richmond adopted a tax rate. Richmond City has one of the highest median property taxes in the United States and is.

Formulating real estate tax rates and conducting appraisals. Richmond County collects on average 062 of a propertys. Along with collections property taxation involves two additional general steps.

The real estate tax rate is 120 per 100 of the properties assessed value. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. City of Richmond City.

The median property tax in Richmond County New York is 2842 per year for a home worth the median value of 461700. A 10 yearly tax hike is the maximum raise allowed on the capped properties. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

What is considered real property. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Taxing units include Richmond county. Personal property tax bills have been mailed are available online and currently are due June 5 2022. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days.

Under the state Code reexaminations must occur at least once within a three-year timeframe. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Car Tax Credit -PPTR.

No Increase In Augusta Property Tax Rates Planned

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

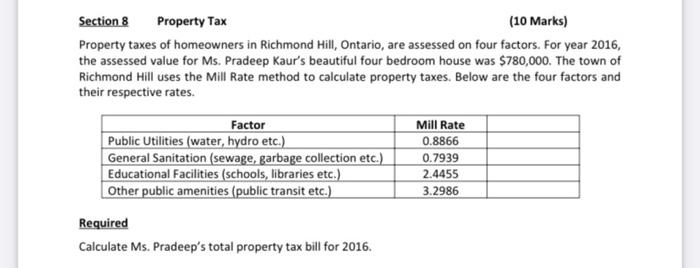

Solved Section 8 Property Tax 10 Marks Property Taxes Of Chegg Com

Fort Bend County Property Values Up 35 Percent Since 2012 Community Impact

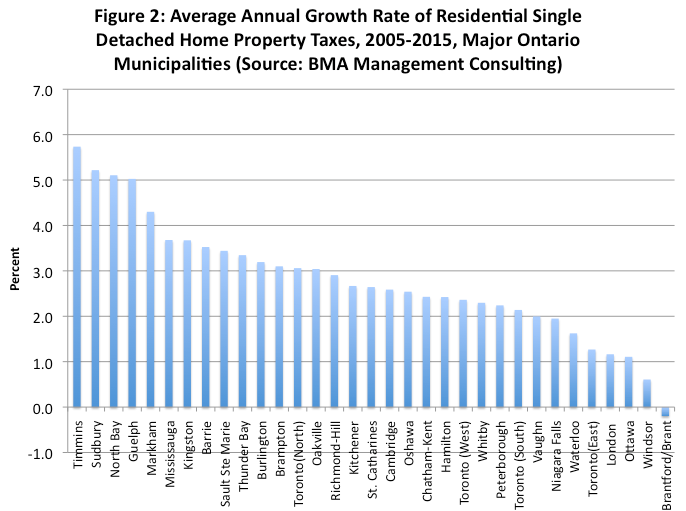

Ontarians Face Growing Property Tax Burden In Many Municipalities Fraser Institute

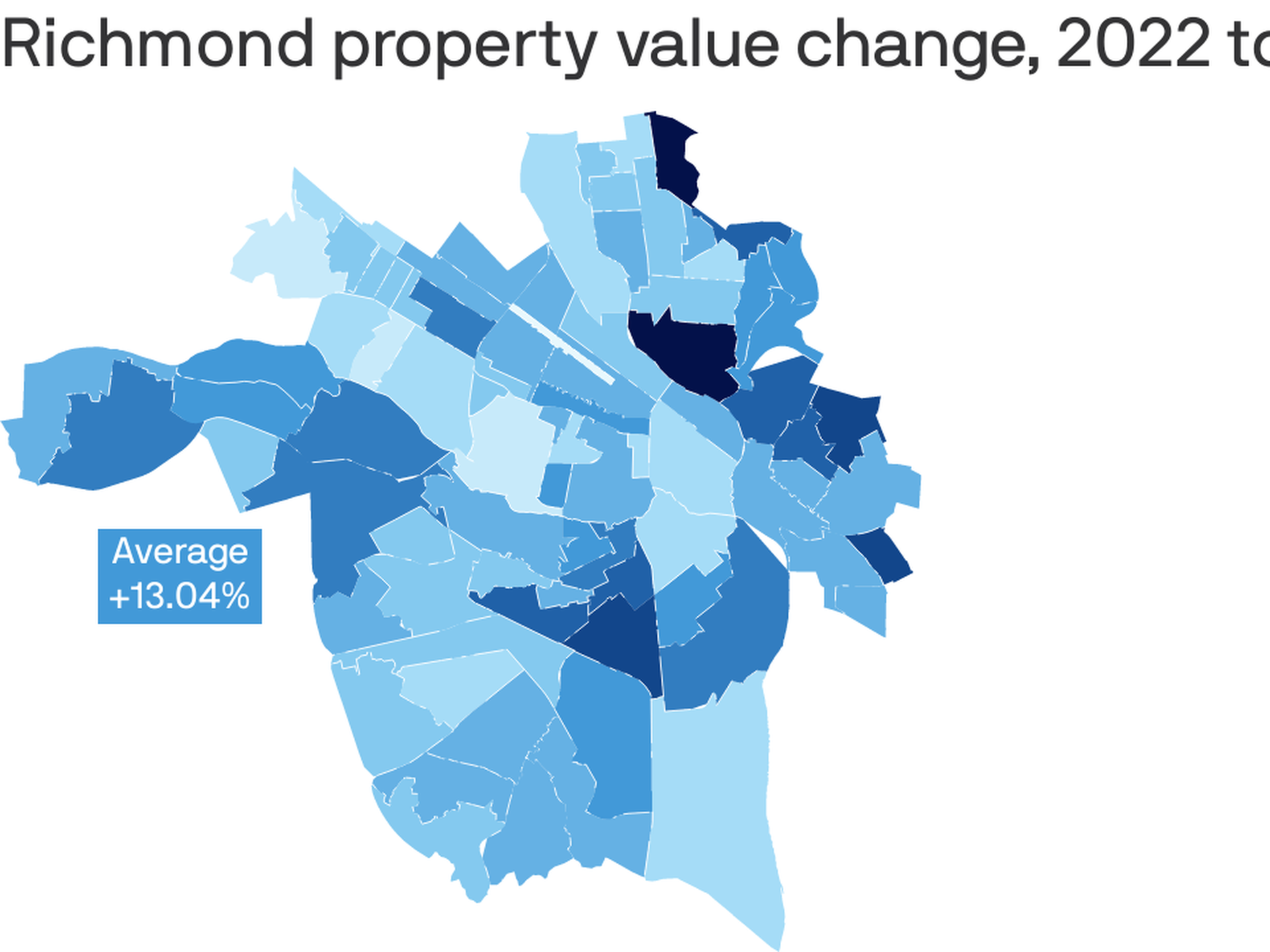

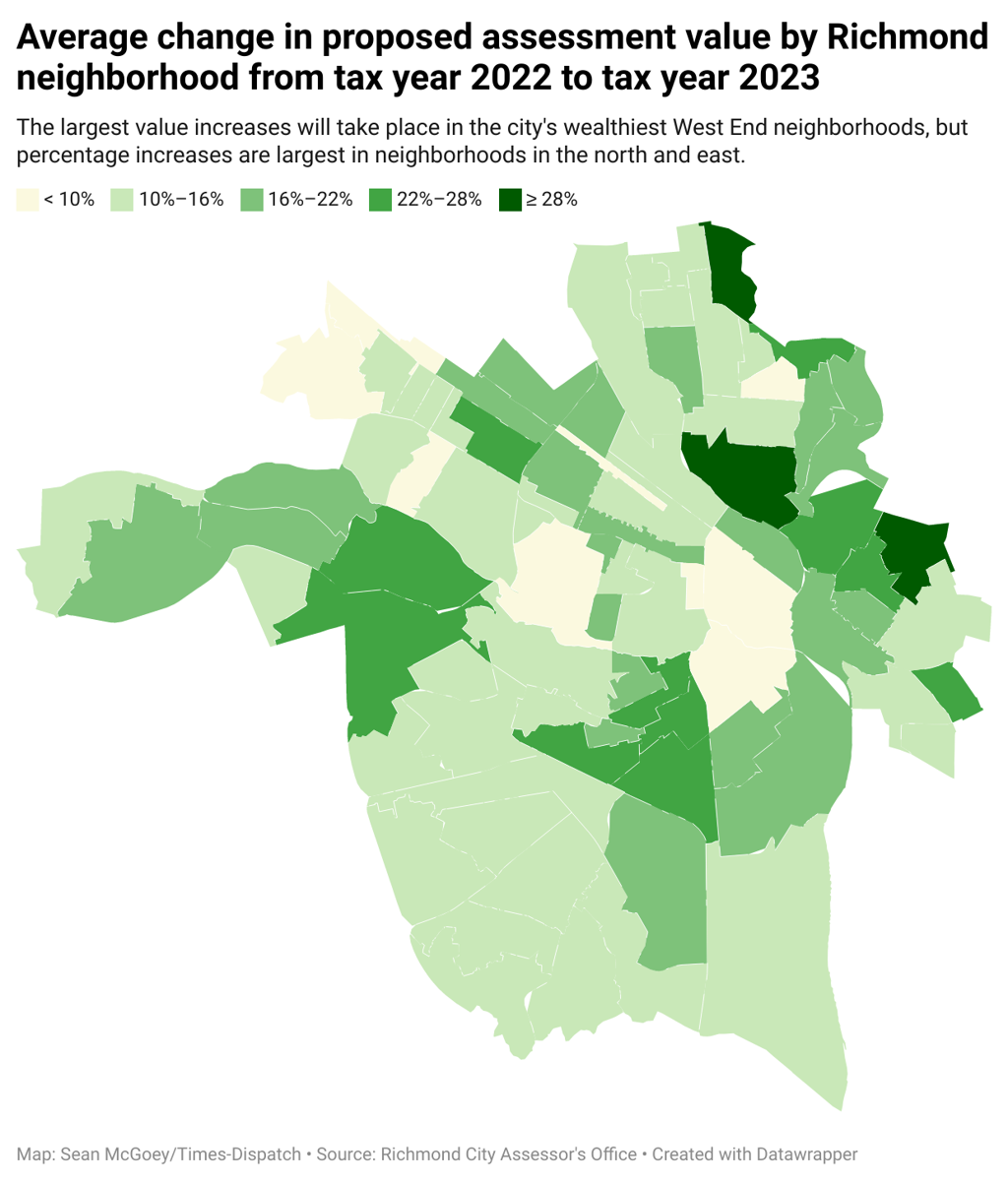

Where Richmond Property Values Went Up Most Axios Richmond

Where Richmond Property Values Went Up Most Axios Richmond

2022 Massachusetts Property Tax Rates Ma Town Property Taxes

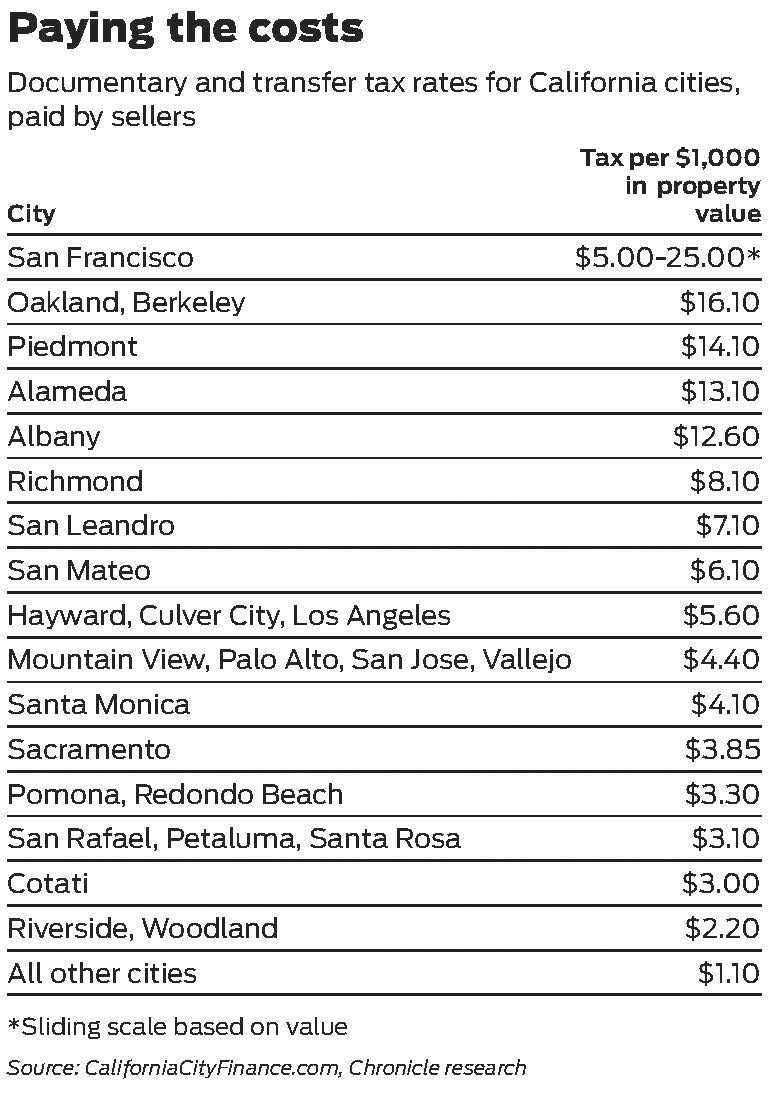

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

With New Cuyahoga County Appraisals Most Property Tax Bills Will Rise See Partial Estimates For Your City Cleveland Com

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

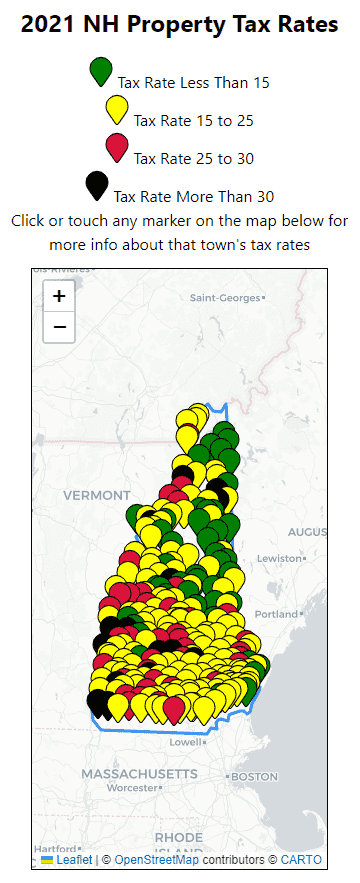

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

New York City Property Tax Rate Is It Worth Selling

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

Wake County Approves Budget With 10 Property Tax Rate Increase Raleigh News Observer